Tag Archives: Euro

Maybe history does repeat itself

At least when it comes to Germany’s interest in benefitting from currency troubles, I mean. Hey Greece, Ireland, Portugal, Spain, Italy… Stay hard-up or shut-up.

”The key principle of German economic policy was to persuade the French and Italians to lower the value of the D-mark so as to make Germany more competitive.”

“The Berlin government’s intransigence over the debt issue, while politically understandable from a German point of view, seemingly pays little heed to the realities of the euro economy, which are heavily tilted towards Germany.”

“In pre-EMU days, if the German economy were growing at an estimated 3.7% as it is this year, the German currency and interest rates would both come under upward pressure – damping exporters’ performance and the growth outlook. Now, however, with all EMU economies shackled together, and devaluation an impossibility for the peripheral countries, the hard-up states have nowhere to hide. Germany continues to profit from excellent export performance — and it can self-righteously point the finger of blame for the euro area’s woes at those debt-ridden peripheral states.”

Germany home alone again

Although the Germans may not have noticed it yet.

Talk about a fistful of dollars. Underscoring the mounting friction between Germany and its G-20 partners concerning the question of finanical policy, Germany’s Finance Minister Wolfgang Schaeuble said that the US plan to pump $600bn into the US economy was “clueless” and would create “extra problems for the world”.

So, like where’s the problem?

Of course the German coalition government needs to talk tough like this because it has to convince everyone here how austere it really is–it trails the opposition in opinion polls before six state elections next year and needs a success “after alienating German voters by supporting the bailout for Greece in May.” Calling US policy makers clueless is just the icing on the cake.

Can’t wait for the G-20 meeting in Seoul next week. To take a look at “united Europe’s” stand on the matter, I mean. Although if you’d ask President Obama, he’d probably tell you that Europe just doesn’t matter.

“Eine ganze Reihe von Amerikanern betrachte Europa zwar nicht als Problem, allerdings längst auch nicht mehr als Teil der Lösung. Obama scheint dazu zu gehören.”

And thanks a million for this one, Joe:

“You won’t find a lot of Keynesians here,” explained one German economic policymaker in Berlin in September. That will not be news to anyone who has spoken to his counterparts in Washington. In their view, Germany is a skulker, a rotten citizen of the global economy, the macroeconomic equivalent of a juvenile delinquent, or worse. It is a smart aleck in the emergency ward that is the global economy. It is a flouter of the prescriptions of the new Doctor New Deal who sits in the White House.

http://www.weeklystandard.com/articles/germany-said-no_513319.html

So when Obama administration officials urge Germans to stimulate, they are wrong, but not for the obvious reasons. It is not that they want to impose socialist programs on a capitalist system that is doing well without them. It is that they want to impose demand-stimulating programs on a system that is already absolutely glutted with them. It is as if the administration’s approach were to take as a baseline whatever any given government happens to be spending, and then to insist that the figure should be, say, 10 percent of GDP higher. This is about as reasonable as assuming your child will be half as likely to get pneumonia if you send him off to school wearing two down parkas.

Do not pass go, do not collect $200

The next euro whammy? Now it’s time to assist Portugal. Bring out your Microcurrency, Germany. But don’t spend it all at one place.

“The alternative currency is not some gimmicky fundraiser. It may look a little like Monopoly money, but the chiemgauer is real. One chiemgauer equals one euro. It’s been around for eight years, almost as long as the euro, the common currency now used by 16 of the 27 EU members.”

Germans go home!

Back home to the German Mark, I mean.

Zillbillionquadrillionaire rich dude George Soros has warned that Germany’s drastic plans to drastically slash its budget over the next four years is like, well, way too drastic and could even lead to the collapse of the euro – some seven hundred and eighty-seven zillbillionquadrillion of these already his own.

“Right now the Germans are dragging their neighbors into deflation,” he said. “Which threatens a long phase of stagnation.” And this is a real abomination. Across the nation.

“If the Germans don’t change their policy, their exit from the currency union would be helpful to the rest of Europe.”

So there we have it. I think.

“Wenn die Deutschen ihre Politik nicht ändern, wäre ihr Austritt aus der Währungsunion für den Rest Europas hilfreich.”

The dollar also rises

Or the Euro falls, I should say.

And it’s fallen to the lowest its been in four years.

Für das abermalige Minus waren nach Angaben von Händlern erneute Sorgen über die hohe Schuldenlast einiger Euro-Staaten sowie schlecht bewertete Arbeitsmarktzahlen aus den USA verantwortlich.

Divided we stand

But at least divided we stand together, in “broad agreement.”

It goes like this: Tim Geithner is all for imposing more conservative rules on financial institutions too, Germany, as long as they’re not too conservative. Germany’s Wolfgang Schäuble, on the other hand, wants kind-of-sort-of the same thing, he says, as long as it’s more conservative than not too conservative and, above all else, international. And as long as it’s German unilateral at the same time too, of course.

Other than that though, they couldn’t agree on much of anything.

“We have a lot in common. We are going to have slightly different approaches. I don’t think we’ll know what separates us until we get to the next stage.”

Germany vs. Europe?

Well welcome to the club, Germany. Like what took you so long?

Now, at the worst possible moment, Germany is turning to nationalist illusions. Europe’s past economic successes are now viewed as German successes.

Europe’s current deep problems are everyone else’s except Germany’s. That is neither realistic nor sustainable. But German politicians and commentators are callously and self-destructively feeding these ideas.

Merkel botched it with the euro – at least as well as we would have

SPIEGEL: But most German politicians are committed to Europe.

Fischer: Only as long as it remains very abstract. But we have to give people enough credit to deal with unpleasant truths. No one explains why the euro is important for Germany and what its failure would mean. And no one explains why Germany has always paid — because it happens to be the big winner in Europe.

SPIEGEL: A community of solidarity means that Germany must pay for the failures of others.

Fischer: What nonsense! The European Union was a transfer union from the very beginning. The common market and the agrarian market were and still are primarily transfer guarantees for Germany and France!

SPIEGEL: How should Merkel have reacted?

Fischer: The chancellor should have put forward her own proposal to rescue the euro, in coordination with France. We have a responsibility as Europe’s strongest economic power. The EU cannot solve its problems in the long run if Germany hides itself. We are paying a high price for our resistance. We are viewed with suspicion in the entire Mediterranean region, and are seen as villains in Greece.

Ground Zero? Here?

“Ground zero of Europe’s debt-currency-banking crisis isn’t in Greece, or Portugal, or Ireland or even Spain. It’s in Germany.”

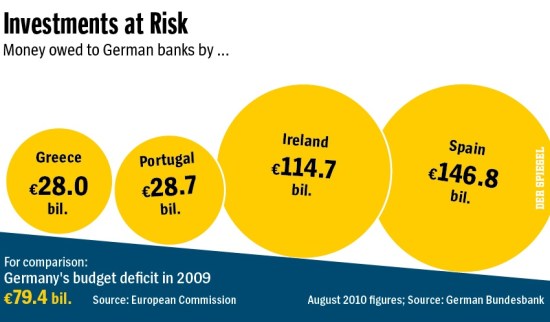

“At one end is a powerful and highly efficient industrial export engine that generates a large trade surplus with the rest of the world, including most other countries in the eurozone. Instead of spending this new export wealth on a higher standard of living, however, parsimonious Germans prefer to save it, handing it over to thinly capitalized German banks that have proved equally efficient in destroying said wealth by investing it in risky securities issued, not coincidentally, by trading partners that need the capital to finance their trade deficits with Germany.”

“What Germans won’t accept is that they wouldn’t have been able to sell all those beautifully designed cars and well-engineered machine tools if Greeks and Spaniards and Americans hadn’t been willing to buy those goods and German banks hadn’t been so willing to lend them the money to do so. “