Time for a new European currency yet?

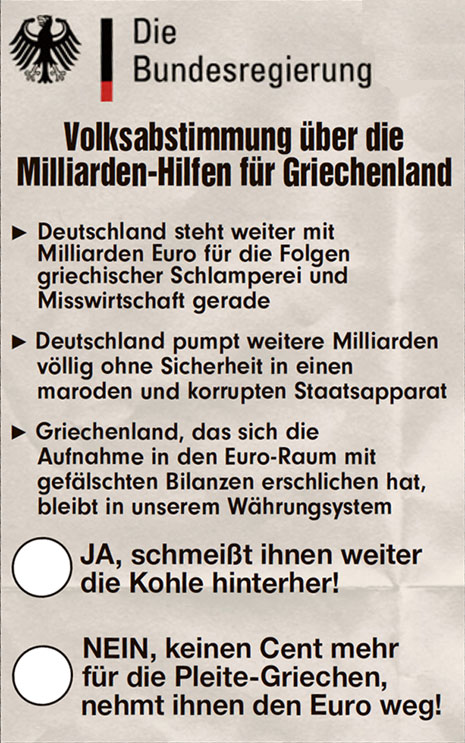

“The real threat to the euro isn’t that a weak peripheral country like Greece might withdraw in an effort to devalue its way to competitiveness, but rather that Germany might want to pull out.”

This guy makes a very interesting point. He goes into what he defines as the three main problems that have led Greece, Portugal, Ireland and Spain (not yet, but soon) to the dismal position they are now in and suggests that because of the coming bailout fatique, the only way to save the union is, well, to divide it. This could best be done by introducing an Über Euro in the non-bailout nations.

“Germany’s incentive to leave grows with each bailout, and Berlin could ultimately make a simple calculation that extrication will be less costly than continuing the sacrifice needed to keep the euro.”

To avoid this, one could strike a grand bargain by creating this new currency. “These nations then announce that all obligations between their citizens will henceforth be denominated in the new currency, the Über Euro, which would eventually be managed by the Bundesbank. The Über Euro would initially be set at a value of perhaps 1.3 euros, setting the stage for an export boom for countries that continue to use the euro. This would allow the remaining eurozone members to restore their competitiveness without having their financial systems go bankrupt; it also would allow Germany to sell the plan as saving Europe without breaking up the EU.”

“Should the remaining euro countries continue irresponsible fiscal policies, the European Central Bank (which would continue to be their central bank), would slowly monetize their debt. The euro would continue to depreciate against the Über Euro and perhaps end up as junk currency. …The ECB’s stature would be diminished and its balance sheet probably trashed.”

Sounds like a good plan to me (for world domination?). But I’m not very good with money, either.

There is no inherent reason the European project cannot proceed with two currencies and the citizenry may force this outcome.

PS: Beware, Greece. As the Wall Street Journal puts it, there’s a Wolfgang at your door.