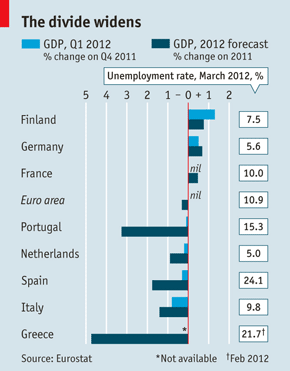

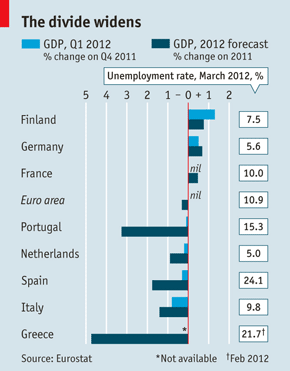

There’s Germany, it seems. And then there’s (practically) everybody else in Europe.

The Economist notes: The hope is that Germany, which produces over a quarter of euro-zone output, can pull along the rest. But the worry is that the latest bout of euro sickness may sap confidence even in Germany, aborting a broader recovery.

With unemployment at 6% compared with a 15-year high of 11% across the euro zone and over 20% in Spain and Greece, Germans feel less pressure to save in case they lose their jobs. And a more confident Germany helps everyone by spending more on imports. German inflation at 2.2% is now below average.

German resilience reflects several strengths. Although growth in the first quarter was helped by exports, the usual mainstay, it has increasingly been backed by domestic demand, which accounted for three-quarters of GDP growth in 2011. This reorientation has happened because Germany avoided the debt excesses (? hmmm, relatively speaking perhaps, but I’ve seen some other numbers here), both private and public, that inhibit growth elsewhere. With relatively low debt, German households and firms can borrow more. What is more, they can do it at rock-bottom rates. Paradoxically, Germany is benefiting from the euro crisis, as investors seek a haven. Yields on ten-year German government bonds have fallen below 1.5%.

Paradoxically, Germany is benefiting from the euro crisis, as investors seek a haven. Yields on ten-year German government bonds have fallen below 1.5%.

And yet, after having read all these impressive figures up there, there’s another German paradox I keep running into here all the time: Germans on the street aren’t nearly as confident as this article wants to imply, at least not when it comes to the euro and the euro-zone. How else do you explain the fact that nearly every second German now thinks that the introduction of the euro was a big honking mistake in the first place?

Die Euro-Einführung war ein Fehler, glauben knapp die Hälfte der Deutschen.