More and more Americans are being punished for their poverty: Above all in rural areas judges have been putting delinquent debtors in prison as of late. This medieval practice is illegal, unconstitutional – and widespread.

“Diese Unsitte verbindet man mehr mit der Zeit von Charles Dickens als mit dem modernen Amerika.”

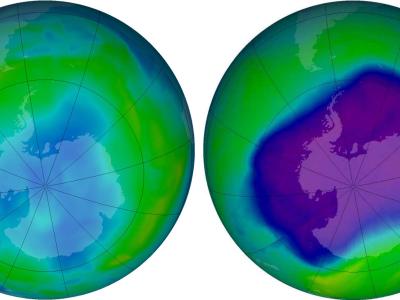

PS: Speaking of deplorable customs and disturbing developments – and good fiction – when are these deplorable refutations of sacrosanct scientific certainties ever going to stop?! I mean, what ever happened to the ozone hole? It’s not there anymore or something.

Well it’s One drink of wine, two drinks of gin… and I’m lost in the ozone again.