So, is it time for the sweet poison or the silver bullet? Germany (or one German) is the last man standing and it’s time to pay up or shut up.

Can Germany (and Germany’s “independent” Bundesbank President Jens Weidmann) jump over its/his shadow and allow the European Central Bank to become the lender of last resort in Europe’s never-ending efforts to prop up the euro?

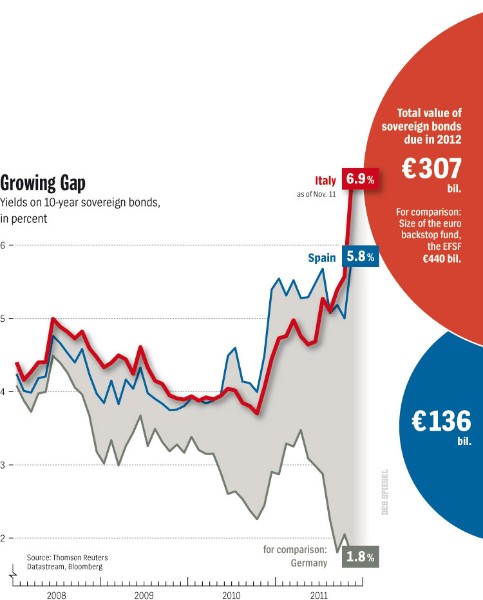

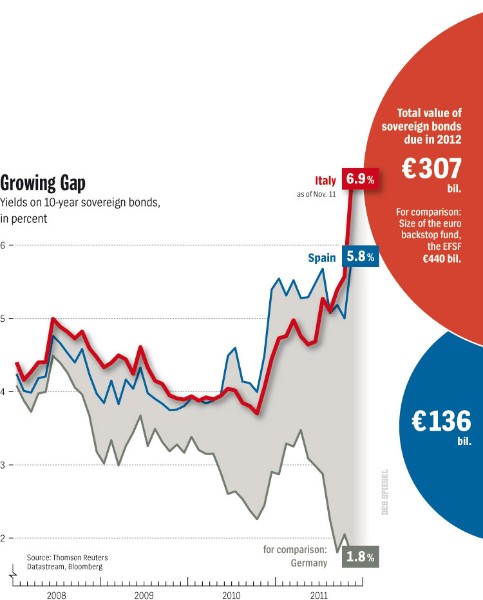

Pump up the volume already. Half a dozen bailout packages and half a trillion euros later, Greece is closer to leaving the euro zone than ever before and Italy now seems bound for bankruptcy, too. Who’s next? And where’s the money? It looks like Europe’s arsenal is down to one last taboo here: Let the ECB vouch for all of the outstanding debt of the debtor nations, “permanently, to an unlimited extent and in violation of all applicable laws.” Germany, for some strange (and wonderful) reason, is still against doing this.

You know the deal, my fellow Americans. It’s the easy way out: “Print money and drown the debt crisis in a sea of liquidity.” Look what its done for us – so far.

Hey look, I don’t know much about economics (nor do at least half of the world’s economists, for that matter), but I do know that if President Barack Obama, President Nicolas Sarkozy and European Commission President José Manuel Barroso are all urging the Germans to abandon their resistance to the ECB plan, it’s probably best for the rest of us out there if this Weidmann guy sticks to his guns. I wouldn’t bet money on him doing so, though. And I certainly wouldn’t bet using the euro.

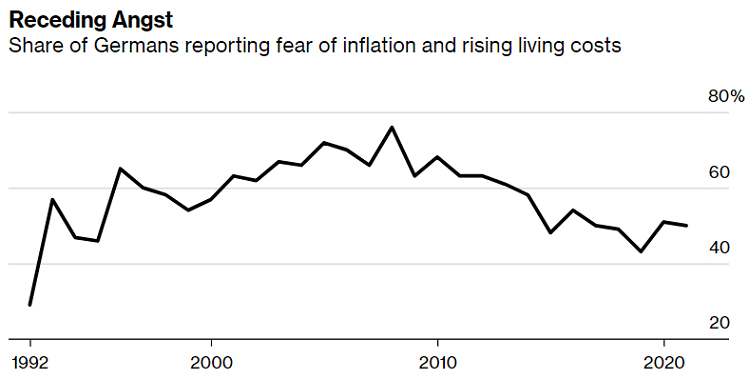

He mechanically recited the traditional mantras of the Bundesbank: “independence,” “a culture of stability” and “credibility.”